Life is unpredictable, and sometimes, unexpected expenses like medical bills, car repairs, or urgent home fixes can arise without warning. When your savings aren’t enough, and you need cash fast, payday loans often come up as an option. These loans promise quick access to money with minimal hassle, often advertising instant approval and fast funding.

But can you really get instant approval for payday loans near you? How does the process work, what do lenders look for, and what should you know before applying? This article dives deep into these questions, exploring the reality of payday loans, the concept of instant approval, and how you can find payday loans near you responsibly.

Key Takeaway

Instant approval payday loans can offer quick financial relief, but the high fees and short repayment terms mean they should be used cautiously. Always verify lender legitimacy, compare offers, and consider less expensive borrowing options to protect your financial wellbeing.

What Are Payday Loans?

Small Loan Amounts:

Payday loans typically involve borrowing relatively small sums of money. The loan amounts usually range from $100 to $1,500, although the exact limit depends on factors such as your income level and the legal restrictions in your state. The smaller loan size is intended to cover immediate, unexpected expenses rather than long-term financing needs.

High Interest Rates:

One of the defining—and often criticized—features of payday loans is their extremely high interest rates. The Annual Percentage Rates (APRs) on payday loans can easily exceed 300% or more, making them among the costliest types of credit available. The high rates reflect the short-term nature of the loans and the higher risk lenders take by offering loans to borrowers with poor or no credit. While the dollar amount of interest might seem small due to the brief loan term, the effective cost over a year is very high.

Short Repayment Terms:

Payday loans have very brief repayment periods, typically requiring you to repay the loan within 14 to 30 days—often by your next payday, hence the name. This means you need to come up with a lump sum payment relatively quickly, which can put pressure on your finances. Unlike traditional loans that offer months or years to repay, payday loans demand quick payback, often leaving little room for financial flexibility.

Minimal Eligibility Criteria:

Unlike traditional loans, payday loans usually have minimal eligibility requirements, making them accessible to a wide range of borrowers, including those with poor credit scores or limited credit history. Instead of focusing heavily on credit checks, lenders typically verify that you have a steady source of income and an active checking account. This low barrier to entry makes payday loans an option for individuals who might not qualify for other forms of credit.

Purpose and Use Cases

Payday loans are designed to cover urgent, unexpected expenses such as:

- Emergency medical bills

- Car repairs

- Utility payments to avoid shutoff

- Rent or mortgage shortfalls

- Other unplanned financial emergencies

The intention is to provide quick relief in a financial pinch, not to finance ongoing expenses or long-term needs.

Risks to Consider

While payday loans can offer fast cash, the high costs and short repayment window make them risky for many borrowers. The combination of high interest and quick repayment can lead some individuals into a cycle of debt, where they need to keep taking out new payday loans to cover old ones, escalating fees and financial strain.

Legal Regulations

Payday loan regulations vary widely by state and country. Some jurisdictions have strict caps on loan amounts, fees, and interest rates or have banned payday loans entirely due to concerns about predatory lending. Always check local laws before considering a payday loan.

Can You Get Instant Approval for Payday Loans Near You?

Understanding Instant Approval

.jpg)

Instant approval refers to a lender’s ability to review your payday loan application and deliver an approval or denial decision immediately or within a very short time—often just minutes after you submit your information. This rapid response is largely possible because many payday lenders, especially those operating online, employ automated underwriting systems that can quickly verify your eligibility based on the data you provide.

The concept of instant approval is crucial for payday loans, as these loans are intended to provide fast access to cash for emergency expenses. Waiting days or weeks for approval would defeat their purpose.

How Instant Approval Works

The approval process for payday loans is designed to be fast, simple, and convenient. Here’s how it typically unfolds:

Basic Eligibility Verification

The lender quickly verifies key eligibility criteria such as:

- Identity: Confirming you are who you say you are, often through government-issued IDs.

- Age: You usually must be at least 18 years old.

- Income level: Lenders want to ensure you have enough income to repay the loan by your next payday.

- Bank account activity: An active checking account in good standing is essential, as repayments are often made via automatic debit.

- Residency: Verifying that you live in a state or area where payday lending is legal and the lender is authorized to operate.

Minimal Documentation

Unlike traditional loans, payday loans require minimal paperwork, which speeds up the process. Commonly requested documents include:

- Recent pay stubs or bank statements for income verification.

- A valid government-issued ID (driver’s license, passport, etc.).

- Proof of an active checking account where funds can be deposited and repayments withdrawn.

Soft Credit Checks or No Credit Checks

Most payday lenders do not perform hard credit inquiries, which means your credit score will not be negatively impacted during the application. Some lenders may perform a soft credit check, or in many cases, no credit check at all. This leniency allows faster approval decisions and expands access to borrowers with poor or no credit history.

Automated Systems

Automated underwriting systems analyze your submitted data immediately, cross-checking it against eligibility criteria. If everything matches, the system approves the loan instantly without manual review. Manual review may only occur if the system flags discrepancies or if the loan amount requested is unusually large.

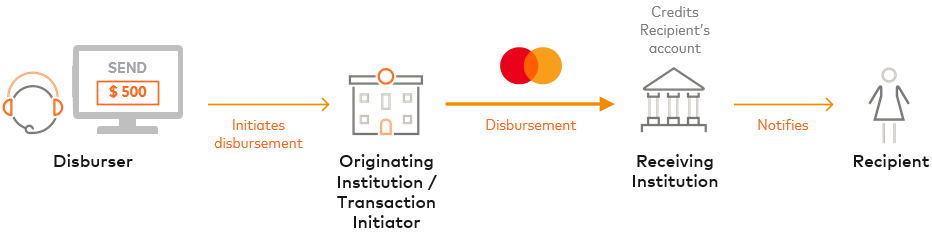

Funds Disbursement

Once approved, many lenders can deposit the loan amount directly into your bank account within hours or at worst, by the same day. This immediate access to cash is one of the main appeals of payday loans and why instant approval matters.

Availability of Instant Approval Payday Loans Near You

Whether or not you can access payday loans with instant approval “near me” depends on a few important factors:

State Laws and Regulations

Payday lending is a highly regulated industry. Some states have banned payday loans altogether, while others impose strict limits on loan amounts, fees, interest rates, and repayment terms. Because of these legal restrictions, availability varies widely depending on where you live. Before applying, check your state’s payday loan laws to ensure these loans are legal and understand any consumer protections that apply.

Presence of Licensed Lenders

Even if payday loans are legal in your state, you need to find lenders licensed to operate in your area. Some lenders have physical storefronts, especially in urban areas, while many others operate exclusively online. Online lenders can offer instant approval nationwide or across many states, provided they have the appropriate licenses.

Your Personal Eligibility

Instant approval depends on meeting the lender’s minimum requirements, which often include proof of steady income, an active bank account, and valid identification. If you meet these criteria, your chances of instant approval improve significantly.

Factors Affecting Instant Approval for Payday Loans

Your Credit and Banking History

Although payday lenders typically do not emphasize traditional credit scores like banks or credit card companies, your banking history plays a crucial role in instant loan approval. Lenders generally require you to have an active checking account that is in good standing. This means no recent overdrafts, bounced checks, or returned payments. A stable banking record demonstrates your ability to manage funds responsibly and assures lenders that repayments via automatic debit are more likely to succeed. Some lenders even perform a soft check on your banking activity to gauge financial behavior before approving the loan instantly.

Income Verification

Payday lenders want to ensure that you have a reliable source of income to repay the loan on time, given the short-term nature of these loans. During the application process, you may be asked to provide proof of income, such as recent pay stubs, direct deposit statements, or bank statements showing regular income deposits. This verification helps lenders assess your repayment capacity. Having consistent, verifiable income increases your chances of instant approval, as it reduces the lender’s risk of default.

Application Accuracy

The accuracy and completeness of your application are critical to getting instant approval. Errors such as incorrect Social Security numbers, mismatched names, or incomplete income details can cause delays or even denial of your loan. Providing precise and truthful information—including your contact details, employment status, and income documentation—enables the lender’s automated systems to quickly verify your eligibility. Double-check your application before submission to avoid unnecessary setbacks.

Lender Policies

Each payday lender sets its own underwriting criteria and approval policies, which can vary widely. Some lenders have more flexible rules designed to approve more applicants quickly but may compensate with higher fees or interest rates. Others may enforce stricter verification processes, requiring additional documentation or longer review times, which can delay approval. Understanding that each lender operates differently helps you manage expectations and choose lenders known for fast, reliable approvals.

Advantages and Disadvantages of Instant Payday Loan Approval

| Advantages | Details |

|---|---|

| Rapid access to cash | Once approved, funds are often deposited the same day or within 24 hours, making payday loans ideal for urgent financial needs like emergencies or bills. |

| Simple application | The process requires minimal paperwork—usually just proof of income, a valid ID, and a bank account—allowing for quick and hassle-free applications. |

| Accessibility | Payday loans don’t rely heavily on credit scores, making them accessible to individuals with poor or no credit history who might be denied elsewhere. |

| Convenience | Online platforms let you apply 24/7 from any location, eliminating the need to visit a physical store, saving time and effort. |

| Disadvantages | Details |

|---|---|

| High interest rates | Payday loans often carry extremely high annual percentage rates (APRs), sometimes exceeding 300%, significantly increasing the cost of borrowing. |

| Short repayment terms | Loans usually must be repaid within 14 to 30 days, which can put pressure on borrowers to come up with a lump sum quickly, risking default or rollover. |

| Risk of debt cycle | Borrowers who cannot repay on time may roll over or take new loans to cover old ones, creating a cycle of debt that can be difficult to escape. |

| Limited availability | Payday loans are banned or heavily regulated in some states and regions, limiting access and sometimes pushing borrowers toward unregulated or predatory lenders. |

How to Find Payday Loans Near You with Instant Approval

Use Online Loan Locators and Search Tools

One of the fastest ways to find payday loans near you is by using specialized online loan locator websites or search tools. These platforms allow you to enter your zip code or city, and they generate a list of payday lenders licensed to operate in your area. Many of these sites also compare different lenders’ offers, helping you to quickly access applications for loans that can provide instant approval and same-day funding. This streamlines the process, letting you avoid physically visiting multiple lenders or spending hours searching for options. Using these tools ensures you are matched with legitimate lenders who comply with state regulations.

Check Your State’s Payday Loan Laws

Before applying, it’s crucial to understand the legal landscape for payday loans in your state. Payday loan regulations vary widely across the U.S.—some states allow payday loans with certain restrictions on loan amounts, fees, and repayment periods, while others have banned them outright. Researching your state’s laws helps you avoid unlicensed or illegal lenders, which can expose you to scams or predatory practices. State government websites, consumer protection agencies, or legal aid organizations often provide up-to-date information about payday loan legality and borrower protections. Being informed ensures your loan experience is both legal and safe.

Verify Lender Reputation

With many payday lenders in the market, selecting a reputable lender is essential to protect yourself from fraud and unfair practices. Look for lenders that are officially licensed by your state’s financial regulatory authority. Check online reviews on platforms like the Better Business Bureau, Trustpilot, or Google Reviews to learn about other customers’ experiences. Positive feedback regarding transparency, ease of application, and customer service are good signs. Conversely, numerous complaints about hidden fees, poor communication, or aggressive collection practices are red flags. Additionally, reputable lenders will clearly disclose their loan terms upfront without pressuring you to accept quickly.

Compare Offers

Payday loans can vary significantly in interest rates, fees, loan amounts, and repayment terms. Using payday loan calculators or comparison websites can help you evaluate these differences objectively. Enter loan amounts and terms to estimate your total repayment amount, including all fees and interest. Comparing offers side by side empowers you to select a loan with the most affordable cost and terms that fit your budget. It’s important to consider not just monthly payments but the overall cost of the loan and how quickly you must repay it. Taking the time to shop around can save you money and prevent getting trapped in unfavorable loan agreements.

By following these steps—using online locators, checking local laws, verifying lender credibility, and comparing offers—you can efficiently find payday loans near you with instant approval while minimizing risks.

Alternatives to Payday Loans

Because payday loans are expensive, consider alternatives:

- Personal installment loans: Larger amounts with longer repayment terms and lower interest rates.

- Credit union loans: Credit unions often provide affordable small-dollar loans.

- Employer paycheck advances: Some employers offer advances on your paycheck without fees.

- Borrowing from family or friends: Interest-free and flexible, but approach carefully.

- Negotiating bills: Contact creditors to request payment extensions or hardship plans.

Also Read : Can a Car Loan Calculator Save You Money on Interest?

Conclusion

Instant approval payday loans near you can provide fast cash for urgent needs, but they come with high costs and risks. Approval speed depends on your eligibility, lender policies, and local laws. Before applying, carefully consider whether a payday loan is the best option, understand the fees involved, and explore safer alternatives where possible.

If you decide to proceed, ensure you choose a licensed lender, provide accurate information, and have a clear repayment plan to avoid falling into debt.

FAQs

1. How fast can I get approved for a payday loan?

Instant approval can occur within minutes, especially online. Some lenders fund your account the same day or next business day.

2. What do I need to qualify for instant payday loan approval?

You typically need proof of income, a valid ID, an active bank account, be at least 18 years old, and reside in a state where payday loans are legal.

3. Are payday loans safe?

They are safe if obtained from licensed lenders, but they carry very high costs and can lead to financial problems if misused.

4. Can I get an instant payday loan if I have bad credit?

Yes, many payday lenders do not require good credit, focusing instead on income and bank account verification.

5. How much can I borrow with a payday loan?

Amounts vary by lender and state but usually range from $100 to $1,500.

6. What happens if I can’t repay my payday loan on time?

You may face fees, increased interest, debt collection, and negative impacts on your credit score. Some lenders allow loan rollovers but with additional fees.

7. Are there online payday lenders that offer instant approval near me?

Yes, many online payday lenders provide instant approval if they are licensed in your state and you meet their criteria.