Managing loan repayments can often feel overwhelming, especially when juggling multiple debts or trying to understand complex interest structures. A Loan Payment Calculator serves as an invaluable tool, offering clarity and control over your financial commitments. By inputting basic loan details, such as principal amount, interest rate, and tenure, these calculators provide a clear breakdown of your monthly payments, total interest payable, and the overall repayment schedule. This transparency empowers borrowers to make informed decisions, plan effectively, and potentially save money over the loan’s duration.

Key Takeaways

- Budgeting Made Easy: Accurate monthly payment estimates help in effective budgeting.

- Informed Decisions: Compare different loan scenarios to choose the best option.

- Early Repayment Benefits: Simulate additional payments to understand the impact on loan term and interest.

- Avoid Financial Surprises: Understand the total repayment amount to prevent unexpected financial burdens.

- Tool for All Loan Types: Adapt the calculator for various loan types to assess financial commitments.

Incorporating a Loan Payment Calculator into your financial planning can significantly enhance your ability to manage debt and achieve financial stability

Understanding Loan Payment Calculators

Enhanced Budgeting

Why This Is Important:

For most borrowers, the monthly EMI is a significant part of their financial obligations. If this amount is miscalculated or underestimated, it can create a ripple effect — leading to missed payments, penalties, or borrowing more money to stay afloat.

How the Calculator Helps:

- You enter your loan amount, interest rate, and loan term and instantly see how much your monthly payment will be.

- This allows you to assess whether the EMI fits comfortably within your monthly income and expense plan.

- You can also test different scenarios — for example, changing the tenure from 3 to 5 years to see how much smaller your EMI would become.

Example:

Suppose you want a personal loan of ₹300,000 at 11% interest for 3 years.

- The EMI would be ₹9,811/month.

Now try the same loan with a 5-year tenure: - EMI drops to ₹6,522/month.

Though you pay more interest overall in the longer term, you ease your monthly cash flow. This insight is only possible through a calculator.

Real-Life Benefit:

For someone earning a fixed monthly income, planning around an exact EMI helps avoid missed payments or the need to borrow again to cover living costs.

Informed Decision Making

Why This Is Important:

Loan decisions shouldn’t be made based on just the EMI — you need to know the total cost, how flexible the loan is, and how it fits into your long-term financial plans.

How the Calculator Helps:

- You can test multiple loan configurations to determine which offers the best balance between affordability and total repayment.

- Easily compare offers from different lenders with varying rates, tenures, and processing fees.

- Understand how opting for a shorter or longer tenure impacts your interest cost.

Example:

Compare a ₹5 lakh loan with two interest rates:

- Option A: 9.5% interest for 5 years → EMI: ₹10,537, Total Interest: ₹1,32,225

- Option B: 12% interest for 3 years → EMI: ₹16,607, Total Interest: ₹98,000

While Option B has a higher EMI, you end up saving over ₹34,000 in interest. The calculator brings this insight upfront — empowering you to choose what fits your goals.

Real-Life Benefit:

Instead of relying solely on a lender’s quote, you become an informed borrower who can negotiate better terms or select a more favorable loan product.

Early Debt Repayment Strategies

Why This Is Important:

Making prepayments on a loan can save you a lot of money — but only if you do it strategically. Without clarity on timing and impact, you may waste the opportunity or face penalties.

How the Calculator Helps:

- Most advanced calculators allow you to input extra lump sum payments (e.g., once a year or quarterly).

- It instantly shows the reduction in total interest and the number of months shaved off your loan term.

- Lets you test “what-if” situations — what if I prepay ₹25,000 next year? Will that bring my tenure down by 6 months? The calculator shows it.

Example:

You take a ₹400,000 loan at 10% for 5 years.

- EMI: ₹8,498/month

- Total interest: ₹109,880

Now simulate a prepayment of ₹30,000 after 12 months. - Your loan tenure drops by 8 months.

- Total interest saved: ₹21,500

This insight helps you plan bonuses or tax refunds more productively.

Real-Life Benefit:

If you receive a bonus or tax refund, using it for a prepayment becomes a strategic move rather than a guess, backed by data from your calculator.

Avoiding Financial Surprises

Why This Is Important:

Loans can become costly if you’re unaware of how interest accumulates over time. Without visibility, you may get trapped into paying much more than you borrowed, or be surprised by future EMI increases (in case of floating rates).

How the Calculator Helps:

- It breaks down each EMI into interest and principal components.

- In the early stages of your loan, a larger portion of your EMI goes toward interest — knowing this helps set realistic expectations.

- The calculator also reveals the total repayment amount, which may be significantly higher than the principal alone.

Example:

₹600,000 loan for 7 years at 11% interest:

- EMI: ₹10,253

- Total Repayment: ₹861,252

- Interest Paid: ₹261,252

That’s 43% more than what you borrowed — knowing this up front encourages smarter borrowing or negotiating better rates.

Real-Life Benefit:

You avoid the “sticker shock” of seeing how much you’re actually repaying over time — and can plan for it rather than react to it.

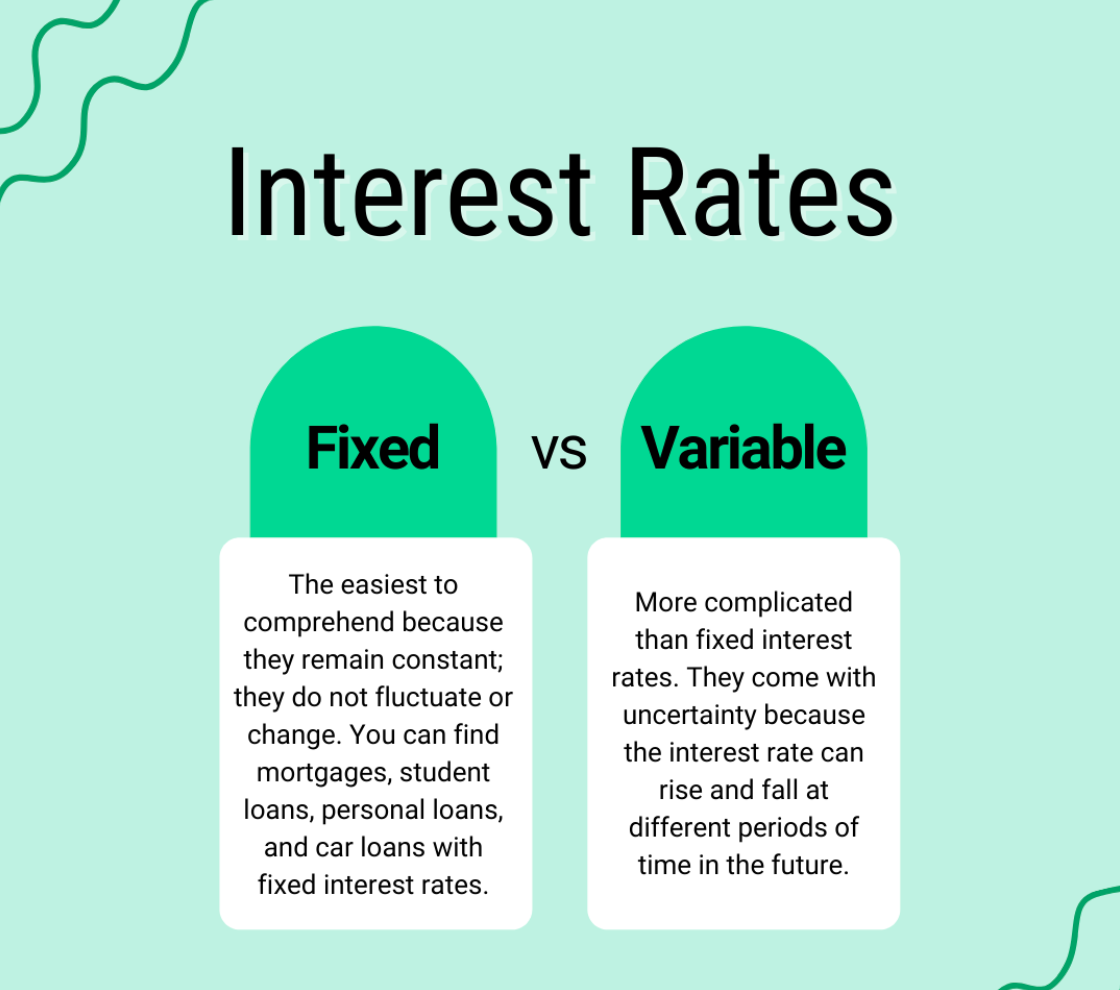

Planning for Variable Interest Rates

Why It Matters:

Interest rates on many loans—especially home loans and some personal loans—can fluctuate based on market conditions. If your loan has a variable or floating interest rate, your monthly payment (EMI) and total repayment amount can change unexpectedly. Without proper planning, these changes can strain your finances.

How the Calculator Helps:

Advanced loan payment calculators allow you to simulate changes in interest rates over time. You can input expected rate increases or decreases to see how they impact your monthly payments and total interest payable.

Real-Life Benefit:

By visualizing potential future payment spikes, you can better plan your budget and set aside extra funds to cover increases—helping you avoid unpleasant surprises and missed payments.

Understanding Impact of Fees and Charges

Why It Matters:

Loans often include additional costs such as processing fees, late payment penalties, and prepayment charges. These fees increase the overall cost of borrowing beyond just the principal and interest.

How the Calculator Helps:

Many loan calculators factor in these one-time or recurring fees, providing a clearer picture of the total cost of your loan. This helps you avoid hidden expenses.

Real-Life Benefit:

Knowing all associated costs upfront allows you to compare loan offers more accurately and avoid choosing loans that seem cheap but have high fees.

Visualizing Loan Amortization Schedule

Why It Matters:

Loans are repaid through a series of installments where a portion goes toward interest and the rest reduces the principal. Understanding this breakdown helps you track your repayment progress and stay motivated.

How the Calculator Helps:

Loan calculators generate detailed amortization schedules that show how each EMI is split between principal and interest, along with your remaining loan balance after each payment.

Real-Life Benefit:

Seeing how your loan balance decreases over time encourages disciplined repayments and helps you identify when it’s beneficial to refinance or make prepayments to save on interest.

Adjusting for Different Repayment Frequencies

Why It Matters:

Loans may require payments monthly, quarterly, or annually. Aligning your repayment schedule with your income stream is essential for smooth cash flow management.

How the Calculator Helps:

Calculators allow you to select your repayment frequency and calculate how it affects your EMI and total interest.

Real-Life Benefit:

If you have seasonal income or irregular cash flow, selecting a repayment frequency that matches your financial situation helps prevent missed payments and financial stress.

Planning for Multiple Loans

Why It Matters:

Managing multiple loans without a clear overview can lead to confusion, missed payments, or excessive debt burden.

How the Calculator Helps:

You can calculate EMIs for each loan and sum them up to understand your total monthly repayment obligations. Some tools also help prioritize which loans to repay first based on interest rates or balances.

Real-Life Benefit:

This comprehensive view prevents over-borrowing and helps you create a repayment strategy that avoids defaults and minimizes interest costs.

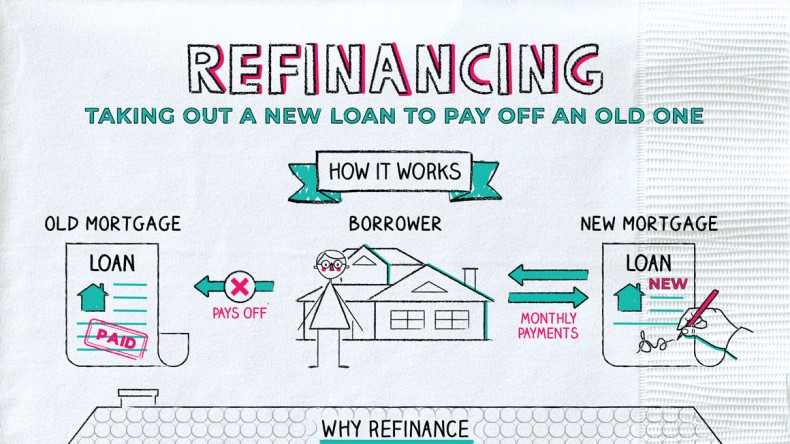

Scenario Planning for Loan Refinancing

Why It Matters:

Refinancing can reduce your interest rate or monthly payments but may involve fees and changes in loan terms.

How the Calculator Helps:

You can simulate refinancing options by inputting new interest rates, loan terms, and fees to compare old versus new loan costs.

Real-Life Benefit:

This analysis allows you to make informed decisions about whether refinancing will truly save money or simply delay payments without real benefits.

Enhancing Financial Literacy

Why It Matters:

Understanding how loans work is critical to making good borrowing decisions and avoiding predatory lending.

How the Calculator Helps:

By breaking down complex calculations into simple inputs and outputs, calculators educate users on loan mechanics, interest calculations, and repayment schedules.

Real-Life Benefit:

More financially literate borrowers are less likely to take on unaffordable debt and more likely to negotiate better loan terms.

Planning for Inflation Impact

Why It Matters:

Inflation reduces the purchasing power of money over time. This means the real value of your repayments in the future may be lower than it seems.

How the Calculator Helps:

Some advanced calculators factor in inflation rates, helping you understand the real cost of loan repayments adjusted for inflation.

Real-Life Benefit:

This helps borrowers see how inflation can ease the real burden of debt over time, making long-term loans more manageable with proper planning.

Key Benefits of Using a Loan Payment Calculator

| Key Benefit | Detailed Description |

|---|---|

| Accurate Monthly Payment Estimation | By entering your loan amount, interest rate, and tenure, the calculator gives a precise monthly repayment amount (EMI). This accuracy helps you plan your monthly budget better and avoid committing to loans you cannot afford. |

| Comparison of Loan Options | You can easily compare different loan offers by adjusting variables like loan tenure, interest rates (fixed vs. variable), and fees. This enables you to identify the most affordable and suitable loan option tailored to your financial needs. |

| Understanding Total Repayment Amount | The calculator shows the full amount you will repay over the life of the loan, including principal and interest. This transparency helps you understand the real cost of borrowing and avoid surprises at the end of your loan term. |

| Planning for Prepayments | By simulating extra lump sum payments or increased monthly installments, the calculator shows how prepayments reduce your principal, shorten the loan tenure, and save on interest costs. This helps you make strategic decisions about early repayment. |

| Visual Amortization Schedules | Detailed amortization tables illustrate how each payment is divided between principal repayment and interest over time. This helps you track your progress, stay motivated, and identify optimal times for prepayments or refinancing. |

| Planning for Variable Interest Rates | For loans with floating interest rates, some calculators let you model how interest rate changes affect your monthly payments and overall cost. This helps you prepare for payment fluctuations and manage your budget accordingly. |

| Factoring in Fees and Charges | Calculators that include processing fees, late payment penalties, and prepayment charges give you a clearer picture of total loan costs, helping you compare loans more accurately and avoid hidden expenses. |

| Adjusting for Repayment Frequency | Allows selection of different payment intervals (monthly, quarterly, annually) so you can align repayments with your cash flow and income schedule, minimizing the risk of missed payments and financial stress. |

| Managing Multiple Loans | You can calculate and sum EMIs for multiple loans to understand your total monthly obligations. Some tools assist in prioritizing loan repayments, helping avoid over-borrowing and reducing the risk of defaults. |

| Scenario Planning for Refinancing | Simulate refinancing by entering new interest rates, terms, and fees, helping you determine if refinancing will save money or just extend your debt. This empowers you to make informed decisions about refinancing options. |

| Enhancing Financial Literacy | The calculator breaks down complex loan calculations into simple inputs and results, educating borrowers about how loans work, how interest is calculated, and how different factors affect repayments, enabling smarter borrowing decisions. |

| Planning for Inflation Impact | Some advanced calculators consider inflation rates to help you understand the real (inflation-adjusted) cost of your repayments over time. This perspective helps with long-term financial planning and assessing the true burden of your debt. |

| Avoiding Financial Surprises | By providing a clear picture of total interest, principal, and fees, the calculator helps prevent unexpected financial burdens and “sticker shock” at the end of the loan term, enabling better preparedness and cash flow management. |

| Supporting Early Debt Repayment Strategies | Simulating various extra payment scenarios motivates disciplined repayment, showing tangible benefits like interest savings and faster debt freedom, encouraging more proactive loan management. |

Also Read : How to secure an MBA scholarship – Tips and tricks

Conclusion

A Loan Payment Calculator is an essential tool for anyone considering taking out a loan. It provides clarity on monthly repayments, total interest, and the overall cost of borrowing. By utilizing this tool, borrowers can make informed decisions, plan their finances effectively, and manage their debt responsibly.

FAQs

1. What is an EMI, and how is it calculated?

An EMI (Equated Monthly Installment) is a fixed amount paid by a borrower to a lender every month to repay a loan over a specified period. It includes both the principal and interest components.

EMI is calculated using the formula:

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Loan amount

- r = Monthly interest rate (annual rate divided by 12 and converted to decimal)

- n = Loan tenure in months

2. Can a Loan Payment Calculator help with early repayment planning?

Yes. Most loan calculators allow you to simulate prepayments or lump sum payments. This feature shows how making extra payments can reduce your loan tenure and save you money on interest, helping you plan for early repayment effectively.

3. Are online Loan Payment Calculators accurate?

In general, yes. Most reputable calculators (like those from banks or finance websites) use standard mathematical formulas. However, always verify that the calculator accounts for real-world factors like compounding frequency and repayment method to get the most accurate results.

4. Do Loan Payment Calculators consider prepayment penalties?

Most basic calculators do not factor in prepayment or foreclosure charges. If your lender imposes such fees, it’s important to check their policies and factor those separately into your repayment plan.

5. Can I use a Loan Payment Calculator for any type of loan?

Yes, with some adjustments. While many calculators are built for personal loans, you can typically use them for home loans, car loans, education loans, and more by customizing the inputs (like tenure and interest rates).

6. Is it necessary to use a Loan Payment Calculator before taking a loan?

While not mandatory, using a calculator is highly recommended. It gives you a clear picture of your monthly obligations, total repayment amount, and helps avoid surprises, especially when comparing different loan options.

7. Can a Loan Payment Calculator help in comparing loan offers?

Absolutely. You can input the terms of different loan options — such as interest rate, tenure, and principal — into the calculator to compare EMIs, total interest payable, and total cost of the loan. This helps in choosing the most affordable and suitable loan for your needs.